MAPFRE Middlesea shifts to a paperless office by introducing digital automation, while enabling the possibility of a hybrid office through Therefore and Scan2x

MAPFRE Middlesea wanted to shift from a paper-based environment to a totally paperless office through the digitisation of their current way of working which involved numerous hard copy files, while streamlining their operations through workflows. At the same time, they wanted to create a hybrid office environment where their employees have the ability to work remotely.

Matthew Micallef , Head of Claims Operations, Cost Control & Policy Maintenance at MAPFRE Middlesea, shares his experience on how MAPFRE Middlesea optimised the operations of the claims department.

MAPFRE Middlesea shifts to a paperless office by introducing digital automation, while enabling the possibility of a hybrid office through Therefore™ and Scan2x

MAPFRE Middlesea wanted to shift from a paper-based environment to a totally paperless office through the digitisation of their current way of working which involved numerous hard copy files, while streamlining their operations through workflows. At the same time, they wanted to create a hybrid office environment where their employees have the ability to work remotely.

Matthew Micallef , Head of Claims Operations, Cost Control & Policy Maintenance at MAPFRE Middlesea, shares his experience on how MAPFRE Middlesea optimised the operations of the claims department.

Which were the main pain points you wanted to address through the solutions you opted for?

Time Saving: Relying only on paper documentation meant losing thousands of employee hours annually in an effort to locate and update our files. Another major concern was, not being able to trace specific files or documents.

Efficiency: Paper-based files were only accessible to a few individuals at any point in time from a specific location. Servicing clients through various branches was challenging, especially of the client-facing employee was not able to access the required files.

Compliance: Compliance issues and audit visits required the tracing of long lists of files and possibly, the transfer of these same files between several other locations.

Coping with emergencies: Dealing with a worldwide pandemic was always seen as a distant and unfathomable scenario before it really happened. Asking employees to work from home in a paper-based office would have proved to be a major stumbling block for our operation.

Cost and Archiving space: Cost of paper, transportation and archiving of files are all costs that add up to the company’s profit and loss accounts at the end of the day.

“Remote working will be available even after the pandemic is over only thanks to Therefore™ .”

Matthew Micallef – Head of Claims Operations, Cost Control & Policy Maintenance, MAPFRE Middlesea

“Remote working will be available even after the pandemic is over only thanks to Therefore™ .”

Matthew Micallef – Head of Claims Operations, Cost Control & Policy Maintenance, MAPFRE Middlesea

Can you tell us how you implemented this project while keeping the transition between your old paper-based office and thet of a new digital hybrid workspace, as smooth as possible?

STAGE 1

The 1st stage was to introduce and train all staff members on the Therefore™ user interface, which brought about a change in the way we operated on a daily basis. This new procedure involved automation via a number of Therefore™ workflows including, automatic email capture and saving within a designated repository, and claim assignment to the appropriate claim handlers. The latter is based on, the policy type and various notifications being triggered to the policy holder and related third parties, during the different stages of the claim resolution process.

Once the necessary configuration was set up and integrated to our core system, a cut-off date was decided by which the new digital system went live. Users were instructed to file all correspondence received via email into the applicable Therefore™ repositories, and any physical documents received were digitised via Scan2x and saved in electronic format in Therefore™.

STAGE 2

Stage 2 of the project addressed the digitalisation of all active paper-based files which we had at that time. Using Scan2x document recognition and capturing features and Therefore™ Document Loader, we were able to scan the thousands of files we had, while transferring and indexing digital documents into the designated repositories, all in a matter of few months.

STAGE 3

Stage 3, which is still yet to be completed, involves the digitisation of our physical archive. This process consists of, the scanning, indexing and transferring into Therefore™, hundreds of thousands of documents. This has enabled us to free up office space and provide secure access to all our users to work remotely with ease. During these difficult pandemic times, we were able to continue with our business operations with minimal disruptions by allowing all our staff to continue working from home. Remote working will be available even after the pandemic is over, only thanks to Therefore™.

Can you tell us how you implemented this project while keeping the transition between your old paper-based office and that of a new digital hybrid workspace, as smooth as possible?

STAGE 1

The 1st stage was to introduce and train all staff members on the Therefore™ user interface, which brought about a change in the way we operated on a daily basis. This new procedure involved automation via a number of Therefore™ workflows including, automatic email capture and saving within a designated repository, and claim assignment to the appropriate claim handlers. The latter is based on, the policy type and various notifications being triggered to the policy holder and related third parties, during the different stages of the claim resolution process.

Once the necessary configuration was set up and integrated to our core system, a cut-off date was decided by which the new digital system went live. Users were instructed to file all correspondence received via email into the applicable Therefore™ repositories, and any physical documents received were digitised via Scan2x and saved in electronic format in Therefore™.

STAGE 2

Stage 2 of the project addressed the digitalisation of all active paper-based files which we had at that time. Using Scan2x document recognition and capturing features and Therefore™ Document Loader, we were able to scan the thousands of files we had, while transferring and indexing digital documents into the designated repositories, all in a matter of few months.

STAGE 3

Stage 3, which is still yet to be completed, involves the digitisation of our physical archive. This process consists of, the scanning, indexing and transferring into Therefore™, hundreds of thousands of documents. This has enabled us to free up office space and provide secure access to all our users to work remotely with ease. During these difficult pandemic times, we were able to continue with our business operations with minimal disruptions by allowing all our staff to continue working from home. Remote working will be available even after the pandemic is over, only thanks to Therefore™.

What results did MAPFRE Middlesea achieve through Therefore™ and Scan2x?

The results achieved are remarkable. Within less than 1 year, the office was fully digitalised, and all open paper-based files were scanned, indexed, archived and fully accessible through Therefore™. The office environment changed drastically from paper files everywhere you look, to a well-organised office environment.

The company has multiple operational areas that process an average of 1,500 to 2,000 new documents per day, not counting the scanning of our physical archives project. With Scan2x and Therefore, users can now save the electronic documents directly in the appropriate repository, then access these files from anywhere, whether they are at the office, at home or even abroad.

Using Therefore™ workflows, we are now able to execute hundreds of automatic processes on a daily basis. These include, sending notifications to clients via email, saving and indexing new documents, and overall, organising our processes without the need of user intervention.

Furthermore, through Scan2x and Therefore™, we have moved to successfully implement a hybrid workspace, where all our employees can work remotely when needed, having access to all their files and documentations.

In addition, we are able to provide internal and external auditors with secure and controlled access to our documents residing within Therefore, allowing them to carry out the audit without requiring our employees to trace and provide endless lists of physical files.

What results did MAPFRE Middlesea achieve through Therefore™ and Scan2x?

The results achieved are remarkable. Within less than 1 year, the office was fully digitalised, and all open paper-based files were scanned, indexed, archived and fully accessible through Therefore™. The office environment changed drastically from paper files everywhere you look, to a well-organised office environment.

The company has multiple operational areas that process an average of 1,500 to 2,000 new documents per day, not counting the scanning of our physical archives project. With Scan2x and Therefore, users can now save the electronic documents directly in the appropriate repository, then access these files from anywhere, whether they are at the office, at home or even abroad.

Using Therefore™ workflows, we are now able to execute hundreds of automatic processes on a daily basis. These include, sending notifications to clients via email, saving and indexing new documents, and overall, organising our processes without the need of user intervention.

Furthermore, through Scan2x and Therefore™, we have moved to successfully implement a hybrid workspace, where all our employees can work remotely when needed, having access to all their files and documentations.

In addition, we are able to provide internal and external auditors with secure and controlled access to our documents residing within Therefore, allowing them to carry out the audit without requiring our employees to trace and provide endless lists of physical files.

Business requirements are constantly changing. How is Therefore™ helping you adapt to these changes?

Development on Therefore is always ongoing. New workflows are integrated into the system as we go along. Employees have realised the potential of document automation and are continually suggesting new ways to develop and improve on the setup of Therefore™. Thanks to the intuitive and easy-to-use workflow builder, we are able to design and implement new business process automations quickly and totally inhouse.

What are your plans for further automation within MAPFRE Middlesea?

Our plan is to continue migrating other areas of our operations to the Therefore™ digital platform. The possibility to create electronic forms (e-Forms) from within Therefore™, is also a steppingstone to the future. By providing our clients and suppliers with the possibility to electronically submit claim forms, enquiries or request for other services, we will continue to eliminate the number of physical documents currently being received and processed, allowing us to save time and provide a better customer experience.

Business requirements are constantly changing. How is Therefore™ helping you adapt to these changes?

Development on Therefore is always ongoing. New workflows are integrated into the system as we go along. Employees have realised the potential of document automation and are continually suggesting new ways to develop and improve on the setup of Therefore™. Thanks to the intuitive and easy-to-use workflow builder, we are able to design and implement new business process automations quickly and totally inhouse.

What are your plans for further automation within MAPFRE Middlesea?

Our plan is to continue migrating other areas of our operations to the Therefore™ digital platform. The possibility to create electronic forms (e-Forms) from within Therefore™, is also a steppingstone to the future. By providing our clients and suppliers with the possibility to electronically submit claim forms, enquiries or request for other services, we will continue to eliminate the number of physical documents currently being received and processed, allowing us to save time and provide a better customer experience.

“Using Scan2x document recognition & capturing features and Therefore™ document loader, enabled us to scan the thousands of files we had, while transferring and indexing digital documents into the designated repositories, all in a few months.”

“Using Scan2x document recognition & capturing features and Therefore™ document loader enabled us to scan the thousands of files we had, while transferring and indexing digital documents into the designated repositories, all in a few months.”

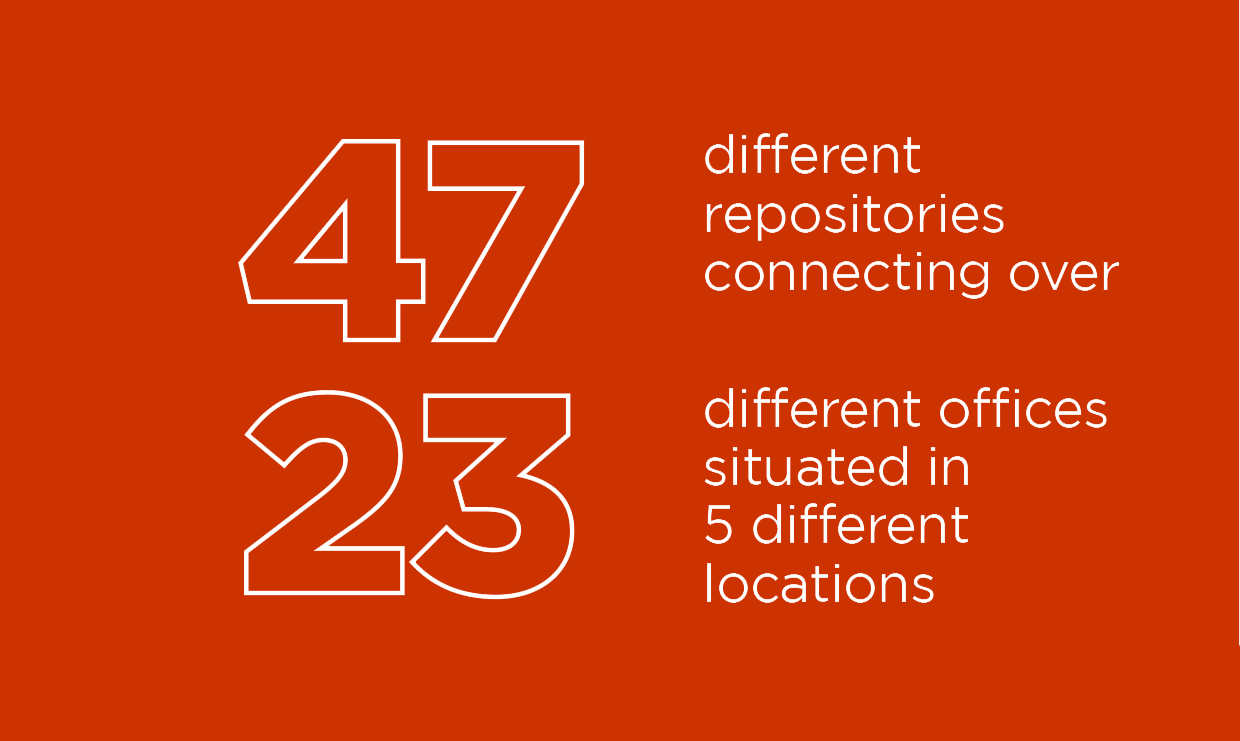

About MAPFRE Middlesea: MAPFRE Middlesea p.l.c. is the leading insurance company in Malta holding leadership positions in the life and non-life market. The Company is a member of the MAPFRE group: a global group operating in 47 countries across five continents. MAPFRE is one of the 10 largest European groups in premium volume, and among the top 20 automobile insurance companies in the United States, with more than 36,000 employees and 23 million customers.

MAPFRE Middlesea’s general business operations comprise all the non-life classes of business underwritten in Malta, including Motor, Home, Health, Marine, and General Liability. MAPFRE Middlesea sells insurance policies through its own offices and via a network of agents and intermediaries. Middlesea Insurance p.l.c. was registered in 1981 as the first Maltese insurance company transacting general business, and in 1994, it was the first insurance company to be listed on the Malta Stock Exchange.

In 2011, MAPFRE International obtained a majority shareholding in Middlesea Insurance p.l.c., and from that date, the company became a member of the MAPFRE group.

About MAPFRE Middlesea: MAPFRE Middlesea p.l.c. is the leading insurance company in Malta holding leadership positions in the life and non-life market. The Company is a member of the MAPFRE group: a global group operating in 47 countries across five continents. MAPFRE is one of the 10 largest European groups in premium volume, and among the top 20 automobile insurance companies in the United States, with more than 36,000 employees and 23 million customers.

MAPFRE Middlesea’s general business operations comprise all the non-life classes of business underwritten in Malta, including Motor, Home, Health, Marine, and General Liability. MAPFRE Middlesea sells insurance policies through its own offices and via a network of agents and intermediaries. Middlesea Insurance p.l.c. was registered in 1981 as the first Maltese insurance company transacting general business, and in 1994, it was the first insurance company to be listed on the Malta Stock Exchange.

In 2011, MAPFRE International obtained a majority shareholding in Middlesea Insurance p.l.c., and from that date, the company became a member of the MAPFRE group.

Interested to know more on how we can help you automate your business workflow and in turn your profits?